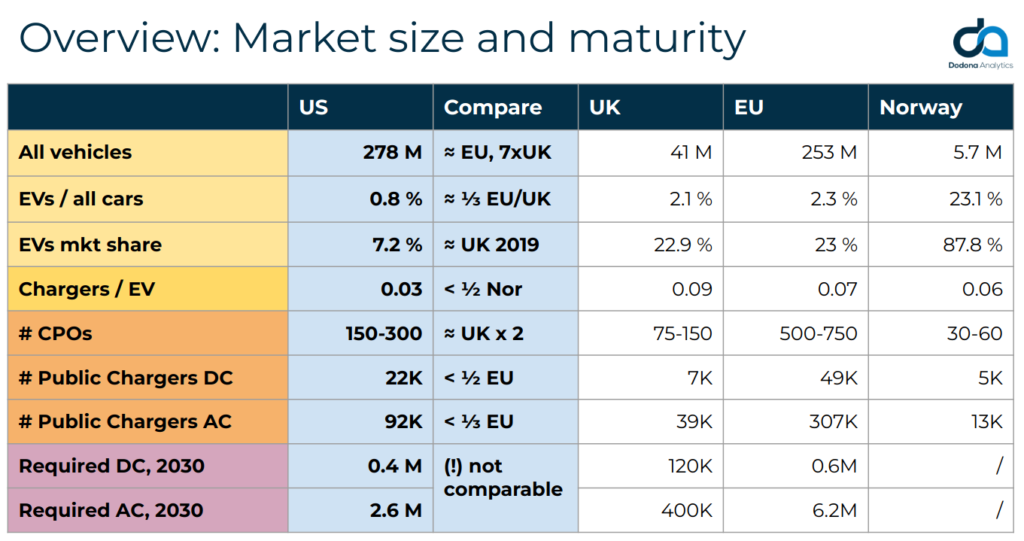

We have seen record-breaking EV sales in Europe over the last several years despite an overall decline of the car market. In different areas, the US is at a stage similar to where Europe was between 2019 and 2021. While there is more at play here, the US has an opportunity to catch up to Europe with the help of the National Electric Vehicle Infrastructure (NEVI) program and the Charging and Fuelling Infrastructure (CFI) program. According to our estimates, the US can catch Europe in terms of EV charging in as little as 18-24 months. The table below gives an overview of EV penetration and an estimate of the number and type chargers required:

But we’ve made some mistakes in Europe…

especially when it comes to EV charging infrastructure, which has lagged electric vehicle adoption (in most cases). Due to the price of electric vehicles and there also currently being no meaningful residual market for vehicles and therefore the geographic is now beginning to change. The Netherlands, for example, have deployed a high number of AC chargers, but in my humble opinion many of them are in sub optimal location to service true demand … but time will tell.

Range anxiety vs charger anxiety

The buildout of Europe’s charging infrastructure has largely been based on alleviating range anxiety and providing public AC charging (Level2) in wealthy urban areas without proprietary off-street parking. This results in having a large number of chargers in convenient locations. But as adoption advances, there has been a shift towards charger anxiety, which was not addressed as infrastructure was planned and installed.

Charger anxiety means that instead of worrying about whether there will be a charger, EV drivers now worry about the reliability of chargers or whether they can deliver the power that is expected. It is not unusual to find a 150 kW charger that only delivers a fraction of that charge.

This anxiety is caused by the increasing frequency of events such as non-functioning chargers, broken or vandalised equipment, or long queues at peak times. This is a problem which is slowing adoption, and it could be avoided or at least minimized in many instances. In our opinion, this has particularly reduced the electrification of fleets and high usage vehicles, such as Uber or Lyft.

The root of the problem is often an inadequate connection between hardware and software that cause issues to go undetected, and it keeps drivers uninformed about what to expect before they reach a charging station. Charge point operators should provide appropriate service and maintenance, focusing on this part of their service regionally before expanding to national levels, where distances make it impossible to see what is happening with their chargers on the other coast of the country.

Social inclusion

Early adopters of EVs have mostly been those with higher incomes and access to at-home charging. With ambitious adoption goals, efforts to include other demographic groups are essential. Despite the shift from range to charger anxiety described above, range anxiety is still an obstacle when driving in rural areas. Based on Eurobarometer data, in 2019, just over 46% of the EU population lived in apartments. For EV owners living in apartment buildings, charging availability is a problem, while another obstacle for those who rely on public charging is price. According to McKinsey, the price of public charging is estimated to be 30 to 200 percent higher than that of private charging. While Europe is facing this challenge after the fact, America has the opportunity to address it during charger deployment, supported by CFI funds.

Forgetting the commercial side

Public money is a great catalyst for change, and it has certainly increased the speed of charger rollout. It is estimated that up to 40% of public chargers in the UK will never be profitable. The charging infrastructure needed to fuel future mobility arguably requires more private investment than public, and the only way to guarantee it is to ensure profitability.

Chargers need to be in the right locations and of the right type for the charging scenario. Governments need to support the private sector by accelerating the installation process, providing subsidies for installation, and bringing stakeholders together. In the UK 18 of the largest operators (many of whom are our customers) have recently come together under the Charge UK to share best practice and encourage the government to do the right thing for eMobility, a similar approach might be good for the US also.

Fragmentation AND Consolidation in Parallel

The charge point operator (or EVCS operator) market remains fragmented. There are around 100 in the UK, with most operators focused on either Level 2 (high volume deployment) or Level 3 & 4 (lower volume but higher cost per charger). This has meant that there are vested commercial interests when it comes to network planning for a particular county or city. Given that there is a need for both types of charging to support eMobility in a given area, this approach has been suboptimal to create a network of the right charging infrastructure for a particular geography.

We are also beginning to see mergers and acquisitions become more prevalent, whilst there continues to be new entrants or CPOs that have a large cash injection to grow their network. We are also being asked by investors to assess the commercial viability and projected utilization for an existing network of chargers, i.e. it is not a straight line for valuation based on the size of the network.

In conclusion, anyone who tells you that planning a charging network is simple does not understand the complexity of the challenge, especially if you are looking to do that sensibly and at scale. As the US continues on this EV transition Journey we would like to share our knowledge and experience of what GOOD looks like and to help you avoid some of the mistakes that Europe has made. If you would like to discuss and understand more about how we can help please drop us a note and we will be happy to help.

About Dodona Analytics

We are Europe’s leading network planning platform working with some of the most ambitious and successful EVCS Operators to help deploy many tens of thousands of chargers every year! As Data Scientists that are experts in Future Mobility and we have been backed by the UK Government to help the US in transitioning to cleaner EV led mobility.